Consulting Invoicing 101: Tools, Examples & Invoice Template

Dec 24, 2025

Estimated Reading Time: 31 minutes

Download the article as a PDF:

Table of contents

- What you will learn in this article

- Why professional invoicing matters for solo consultants

- What a consulting invoice is and how it’s different from standard business invoices

- Essential elements of a consulting invoice template

- Consulting invoice templates and real examples

- Best format, tools, and invoicing software for your consulting invoices

- Frequently asked questions about consulting invoices

- Get the help you need to grow your independent consulting business the right way

What you will learn in this article

If you are dealing with this problem, you are not alone, and you are not imagining the complexity. This article is designed to give you clarity, structure, and a practical path forward.

You will learn:

- How to clearly define the core problem you are facing, so you stop treating symptoms and start addressing the root issue.

- Why common advice in this area often feels incomplete or unrealistic for independent consultants and small firm owners.

- What a more strategic, experience-based approach looks like, and how to apply it without overhauling your entire business overnight.

- How to make decisions with more confidence by understanding what actually works in real client engagements, not just in theory.

The problem this article solves

Many experienced consultants hit a point where effort and results feel misaligned. You are doing solid work, clients are satisfied, yet something is not scaling, stabilizing, or feeling sustainable. This article walks through the underlying reasons that happens and explains what to change so your work supports your goals, not just your clients’ needs.

You will see how to move from reactive decision-making to a more intentional, repeatable approach that supports growth, clarity, and ownership.

The real pain points you are likely experiencing

Most consultants come to this topic feeling frustrated, stretched thin, or quietly uncertain about their next move. Common challenges include unclear positioning, inconsistent revenue, over-customized work, or feeling stuck delivering at a level that no longer matches your experience.

This matters because Google and your prospective clients reward clarity and usefulness. If you are feeling the tension between what you know you are capable of and how your business is currently operating, this article is meant to meet you there and help you move forward with confidence.

Why you can trust this guidance

This perspective is grounded in direct experience advising independent consultants and small firms through these exact challenges. The recommendations here are not abstract frameworks, they are based on patterns seen across real engagements, real proposals, and real delivery constraints.

The strategies discussed have been tested in situations where time, focus, and credibility matter. That experience shapes the guidance you will find throughout this article.

Insights based on serving consultants like you

After working with consultants across industries, certain truths become clear. The most effective changes are rarely about working harder. They are about setting better boundaries, clarifying your role, and designing your services to support long-term leverage.

Throughout this article, you will see examples and considerations that reflect how consultants actually think, decide, and operate. The goal is to help you recognize yourself in the scenarios described and apply the insights in a way that fits your business, not someone else’s template.

Click here for an example of a winning consulting proposal, including a template.

Why professional invoicing matters for solo consultants

For solo consultants, a consulting invoice is not just a payment request. It is a reflection of how you run your business. Clients experience your invoice as part of your service delivery, whether you intend it that way or not. A clear, professional invoice reinforces that you operate with structure, confidence, and intention.

When invoicing feels informal or inconsistent, it quietly undermines your positioning. Even strong client relationships can be strained by unclear payment terms, missing details, or confusing formats. A professional consulting invoice template helps remove friction from the payment process and signals that you take your role seriously.

Professional branding shows up in your invoicing

Your invoice is one of the most repeated brand touchpoints in your business. It should align with the same level of professionalism as your website, proposal, and client communications. Consistent formatting, clear language, and thoughtful presentation all contribute to professional branding.

This matters because clients associate organization with competence. A polished invoice reinforces that they hired someone who runs a business, not someone freelancing on the side. That perception directly affects how clients respect your boundaries, timelines, and fees.

Click here to download a Consulting Proposal template.

Client trust is reinforced through clarity

Trust is built when clients know exactly what they are paying for, when payment is due, and how to complete it. A well-structured consulting invoice removes ambiguity. It outlines services clearly, reflects agreed-upon terms, and reduces back-and-forth questions.

When invoices are vague or inconsistent, clients hesitate. That hesitation can slow payments, create unnecessary follow-ups, or lead to uncomfortable conversations. Clear invoicing supports smoother client relationships and protects your time and energy.

Financial organization supports better decision-making

Professional invoicing also plays a critical role in financial organization. Using a consistent consulting invoice template makes it easier to track revenue, identify patterns, and plan ahead. You gain visibility into what you are billing, what is outstanding, and how your cash flow actually behaves.

For solo consultants, this level of organization supports smarter decisions about pricing, capacity, and growth. It creates a foundation you can rely on as your business evolves, rather than something you have to clean up later.

Click here to take the Independent Consultant’s Pricing Assessment.

Ultimately, professional invoicing is not about aesthetics. It is about reinforcing trust, maintaining clarity, and running your consulting business with the same level of discipline you bring to your client work.

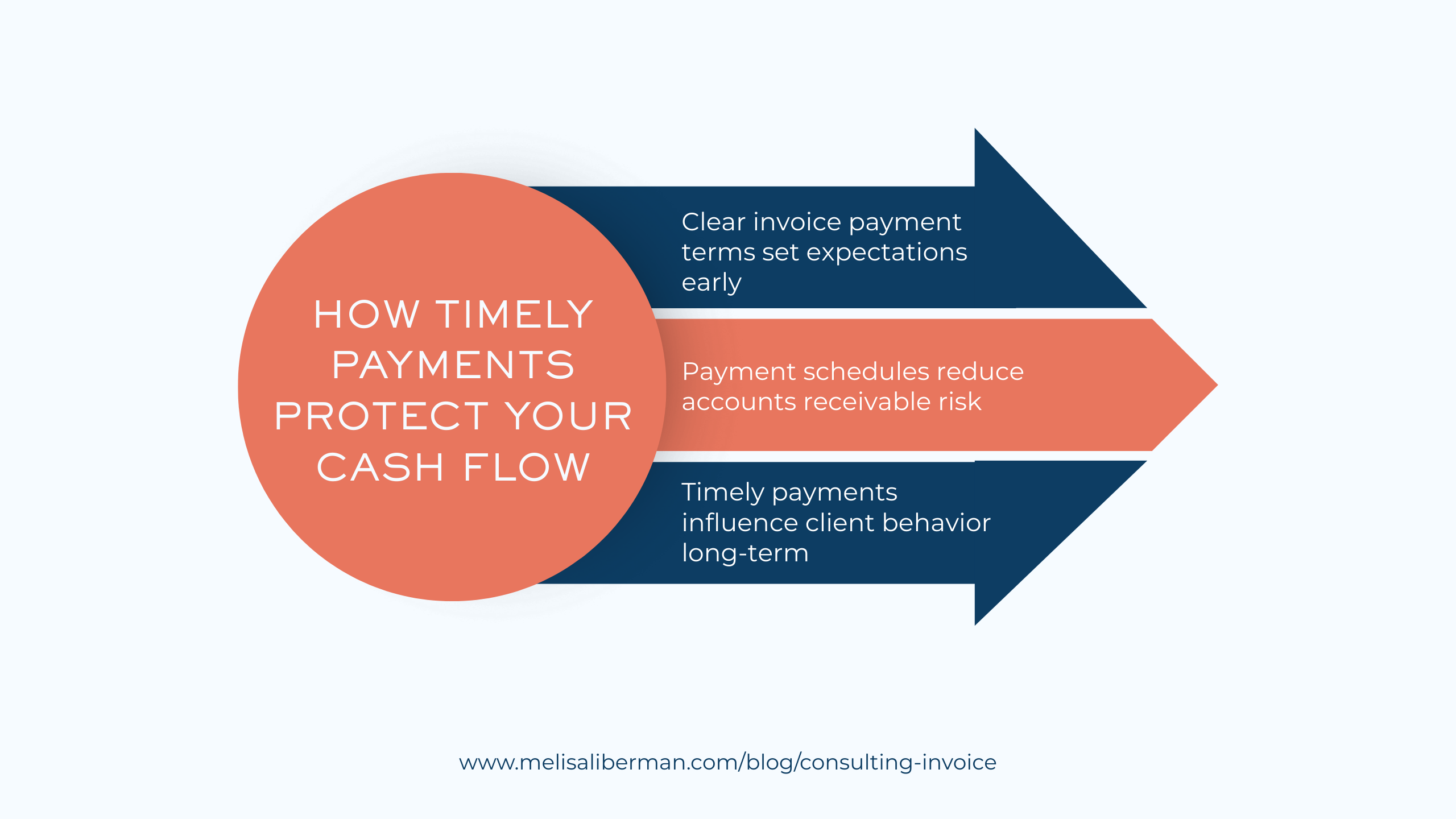

How timely payments protect your cash flow

For solo consultants, cash flow management is less about profit on paper and more about timing. Even a strong month of sales can create stress if payments arrive late or unpredictably. Timely payments give you control over your business operations and reduce the mental load that comes from constantly monitoring accounts receivable.

When cash flow is steady, you can make decisions proactively instead of reacting to shortfalls. That stability affects everything from how you price your services to how confidently you commit to new client work.

Clear invoice payment terms set expectations early

Invoice payment terms are one of the most effective levers you have for improving cash flow. When terms are clear, specific, and consistent, clients are more likely to pay on time. Vague language or flexible exceptions train clients to treat invoices as optional or low priority.

Strong payment terms outline due dates, accepted payment methods, and any late fee policies. They also reinforce that payment is part of the engagement, not an afterthought. This clarity shapes client payment behavior before problems arise.

Payment schedules reduce accounts receivable risk

Payment schedules help protect you from carrying unpaid balances for long periods. Breaking fees into structured milestones or monthly retainers limits your exposure and keeps accounts receivable manageable.

For project-based work, aligning payment schedules with delivery phases ensures you are compensated as value is delivered. For ongoing engagements, consistent billing cycles create predictability for both you and your clients. This approach supports healthier cash flow and reduces the need for follow-ups.

Timely payments influence client behavior long-term

Clients take cues from how you handle billing. When invoices are sent promptly, follow-ups are consistent, and terms are enforced calmly, clients learn to prioritize your payments. Over time, this sets a standard that benefits every future engagement.

Allowing late payments without consequence often leads to repeated delays. Protecting your cash flow means treating invoicing and collections as part of your service process, not an awkward administrative task.

Ultimately, timely payments give you leverage. They allow you to plan, invest, and operate from a place of stability rather than uncertainty, which is essential for any consultant building a sustainable practice.

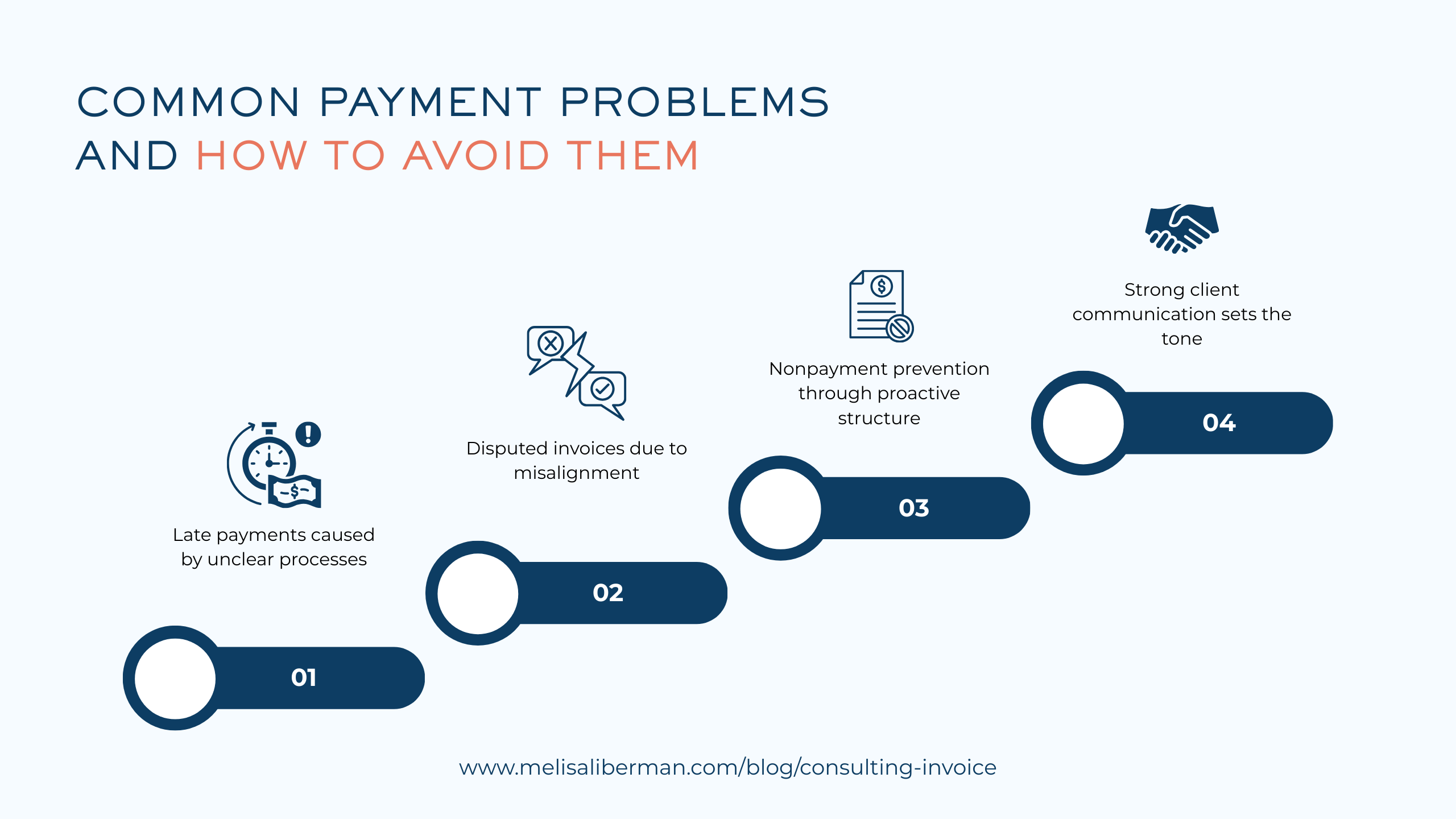

Common payment problems and how to avoid them

Payment issues are rarely about difficult clients alone. In most consulting businesses, they stem from unclear systems, inconsistent communication, or gaps in expectations. Understanding the most common payment problems allows you to prevent them before they impact your cash flow or client relationships.

Late payments caused by unclear processes

Late payments often happen when invoices are sent inconsistently, due dates are vague, or follow-ups feel optional. Clients prioritize what feels organized and enforced. If your process signals flexibility, many clients will take it.

To avoid this, send invoices on a predictable schedule and use clear due dates rather than open-ended language. Automated invoice reminders help reinforce expectations without requiring emotional energy or manual tracking. This keeps payment professional and routine.

Disputed invoices due to misalignment

Disputed invoices usually point back to misalignment earlier in the engagement. This can include unclear scope, vague service descriptions, or mismatched expectations about deliverables. When clients do not recognize the value line item on an invoice, disputes become more likely.

Prevent this by tying your invoice language directly to your proposal and contract. Use consistent descriptions and reference agreed-upon milestones or time periods. Clear client communication throughout the project reduces surprises when the invoice arrives.

Nonpayment prevention through proactive structure

Nonpayment prevention starts before the work begins. Collecting deposits, setting payment schedules, and limiting unpaid work are structural decisions, not trust issues. These practices protect your time and signal that payment is part of the engagement commitment.

If a client does fall behind, timely and neutral follow-up matters. Invoice reminders should be factual, calm, and consistent. Avoid apologizing for requesting payment. Treat it as a normal business process, not a confrontation.

Strong client communication sets the tone

Clear, confident communication around billing builds respect. When clients know what to expect and see that you follow your own processes, payment problems decrease significantly.

Addressing payment expectations early and reinforcing them through consistent invoicing helps maintain healthy client relationships while protecting your business. Over time, this approach filters in clients who respect your systems and filters out those who do not.

What a consulting invoice is and how it’s different from standard business invoices

A consulting invoice reflects how expertise is delivered, not how products are sold. While it shares basic elements with any business invoice, the structure and intent are different. Understanding the distinction between a consulting invoice vs a business invoice helps you bill in a way that aligns with the value of your work.

Standard business invoices are often transactional. They list products, quantities, and unit prices. Consulting invoices, by contrast, support service-based billing where value is tied to outcomes, expertise, and delivery milestones.

Service-based billing requires clearer context

In consulting, clients are paying for thinking, guidance, and execution, not just time. A consulting invoice should clearly connect fees to services rendered, whether that is strategic advising, implementation support, or analysis.

This is especially important when billing for intangible work. Clear descriptions help clients understand what they received and reduce questions or disputes. Strong invoice language reinforces that your work is intentional and structured, not ad hoc.

Project-based work versus billable hours

Project-based work often requires invoices that reference phases, milestones, or deliverables rather than time spent. Instead of listing hours, the invoice might reflect completion of a discovery phase, delivery of recommendations, or ongoing advisory support for a defined period.

When billable hours are used, they should still be framed carefully. Grouping hours by activity or outcome helps clients see value, not just effort. This distinction matters because it shapes how clients perceive your pricing and expertise.

Click here to read How Consulting Rates and Retainers Work.

Consulting deliverables need to be reflected accurately

Unlike standard business invoices, consulting invoices often need to reference deliverables that are not physical. Reports, workshops, strategy sessions, or advisory access should be named clearly so clients recognize the scope of what they are paying for.

This clarity protects you and reinforces professionalism. It also ensures alignment between your proposal, contract, and invoice, creating a seamless experience from sale to payment.

Ultimately, a consulting invoice is a communication tool. When structured thoughtfully, it supports service-based billing, reinforces value, and reflects the level of expertise clients expect when they hire a consultant.

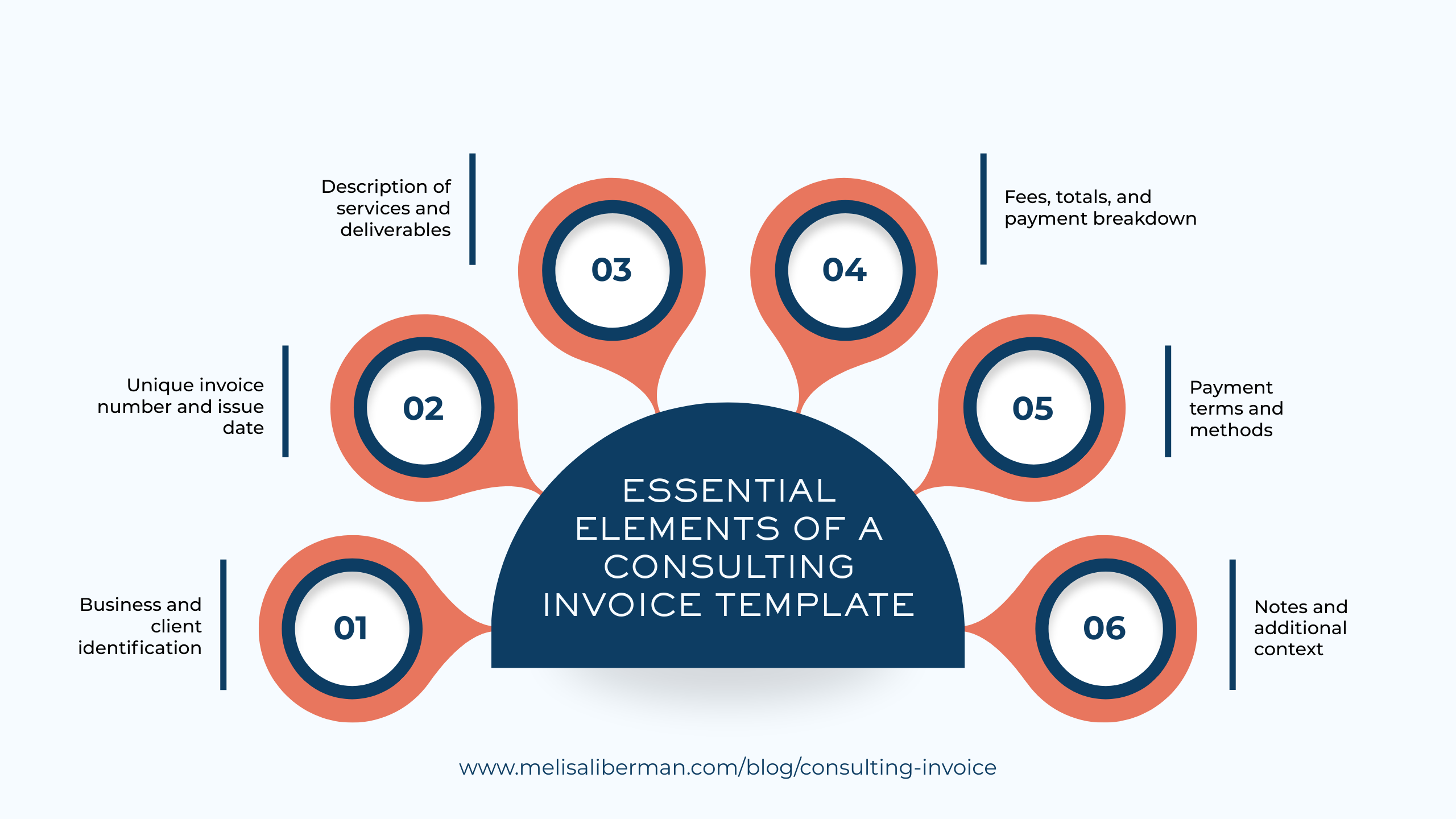

Essential elements of a consulting invoice template

A strong consulting invoice template does more than request payment. It creates consistency, reduces errors, and reinforces trust. When your invoice structure is clear and repeatable, client billing accuracy improves and follow-up work decreases.

Below are the core invoice components every consultant billing template should include.

Business and client identification

Your invoice should clearly identify who is billing and who is being billed. This includes your business name, contact information, and any required registration details, as well as the client’s legal business name and address.

Accuracy here matters. Small inconsistencies can cause delays, especially with larger clients that have accounting processes or approval workflows.

Unique invoice number and issue date

Every invoice needs a unique invoice number and a clear issue date. These fields support record keeping, tracking, and reconciliation on both sides.

They also make conversations about payment easier. Referencing a specific invoice reduces confusion and keeps communication factual and efficient.

Description of services and deliverables

This is where consulting invoices differ most from generic templates. Service descriptions should reflect the actual work performed, whether that is project-based work, advisory support, or billable hours tied to specific activities.

Clear descriptions improve client billing accuracy and reduce the likelihood of disputes. They also reinforce the value of your consulting deliverables.

Click here to read How to Package Consulting Services: Step-by-Step Guide.

Fees, totals, and payment breakdown

Your invoice structure should clearly show fees, subtotals if applicable, and the total amount due. If taxes apply, they should be listed separately and calculated correctly.

Transparency here builds confidence. Clients should be able to review the invoice and understand the total at a glance without needing clarification.

Payment terms and methods

Required invoice fields include payment terms, due dates, and accepted payment methods. This information should be consistent across every invoice you send.

When payment expectations are clear and predictable, clients are more likely to pay on time. This supports healthier cash flow and smoother operations.

Notes and additional context

Optional notes can be used to reference the relevant contract, project phase, or billing period. This extra context can be especially helpful for recurring or long-term engagements.

Used thoughtfully, notes reinforce alignment and professionalism without adding clutter.

A well-designed consulting invoice template protects your time, improves accuracy, and supports stronger client relationships. It is a foundational tool for any consultant who wants to run their business with clarity and control.

Consultant and client contact details

Clear and complete contact information is a foundational part of any professional consulting invoice. While it may seem basic, missing or inconsistent details are a common cause of payment delays and administrative back-and-forth.

Including accurate consultant and client contact details ensures your invoice can be processed quickly and correctly.

Consultant contact information

Your invoice should clearly list your business name and business address, along with a primary email and phone number. This reinforces legitimacy and gives clients an easy way to reach you if their accounting team has questions.

If applicable, include your tax ID number or registration details. Many clients require this information for compliance and record keeping, and omitting it can delay approval or payment.

Client contact information

Client details should reflect the exact legal entity responsible for payment. This includes the client’s business name, business address, and any internal reference or contact person tied to the invoice.

Using the correct client reference is especially important for organizations with multiple departments or locations. It helps route the invoice to the right person and reduces the risk of it getting stuck in review.

Why accuracy matters for payment processing

Accurate contact information supports faster processing, fewer questions, and smoother follow-up if needed. It also protects you if there is ever a dispute, as your invoice clearly documents who the agreement applies to.

Treat contact details as part of your billing system, not an afterthought. Consistency across proposals, contracts, and invoices creates a professional experience and makes payment the natural next step.

Invoice number, issue date, and due date

Invoice identifiers and dates are small details that have an outsized impact on payment speed and invoice management. When these elements are clear and consistent, both you and your clients can track, reference, and process invoices without friction.

Unique invoice ID supports tracking

Every invoice should include a unique invoice ID. This identifier allows for accurate invoice tracking and prevents confusion when multiple invoices are in circulation.

A simple numbering system tied to your billing cycle works well. The goal is consistency, not complexity. Clear invoice IDs make follow-ups easier and keep communication focused on facts rather than explanations.

Issue date defines the billing cycle

The issue date establishes when the invoice was sent and anchors the billing cycle. This date is especially important for recurring work, retainers, or phased projects where timing matters.

Consistent issue dates help clients anticipate invoices and plan approvals. Over time, this predictability improves client payment behavior and reduces delays.

Due date sets payment expectations

The due date communicates payment deadlines clearly. Avoid vague language like “due upon receipt” in favor of a specific date. This removes ambiguity and sets a firm expectation for when payment is required.

Clear due dates also support stronger invoice management on your side. You know exactly when to send reminders and when an invoice becomes overdue.

Together, the invoice number, issue date, and due date create structure. They turn invoicing into a repeatable system that protects your time, improves follow-through, and supports steady cash flow.

Clear service descriptions and deliverables

Clear service descriptions are one of the most important elements of an effective consulting invoice. They connect what you billed to what the client actually experienced, which reduces confusion and reinforces the value of your work.

Vague line items create hesitation. Specific, structured descriptions build confidence and speed up approvals.

Align invoices with your scope of work

Your consulting services list should directly reflect the scope of work outlined in your proposal or contract. Using consistent language across documents helps clients immediately recognize what they are being billed for.

When scope and invoice language drift apart, questions arise. Alignment keeps billing clean and defensible.

Use project milestones for project-based work

For project-based engagements, referencing project milestones is often more effective than listing tasks. Milestones anchor fees to progress and outcomes rather than effort alone.

Examples include completion of discovery, delivery of recommendations, or facilitation of a workshop. This approach supports itemized billing without overwhelming the client with unnecessary detail.

Itemized billing without over-explaining

Itemized billing should provide clarity, not justification. Each line item should clearly state the service or deliverable, the billing period or milestone, and the associated fee.

Avoid turning your invoice into a timesheet unless service hours are contractually required. When hours are included, group them by activity or outcome so the focus stays on value, not minutes tracked.

Service hours when they are required

In engagements that rely on service hours, clarity still matters. Indicate the time period covered, the type of work performed, and how hours were calculated.

This level of transparency protects both parties and reduces the risk of disputes, especially in longer-term or advisory relationships.

Clear service descriptions and deliverables turn your invoice into a confirmation of work completed, not a negotiation. They support smoother approvals, fewer questions, and stronger client trust.

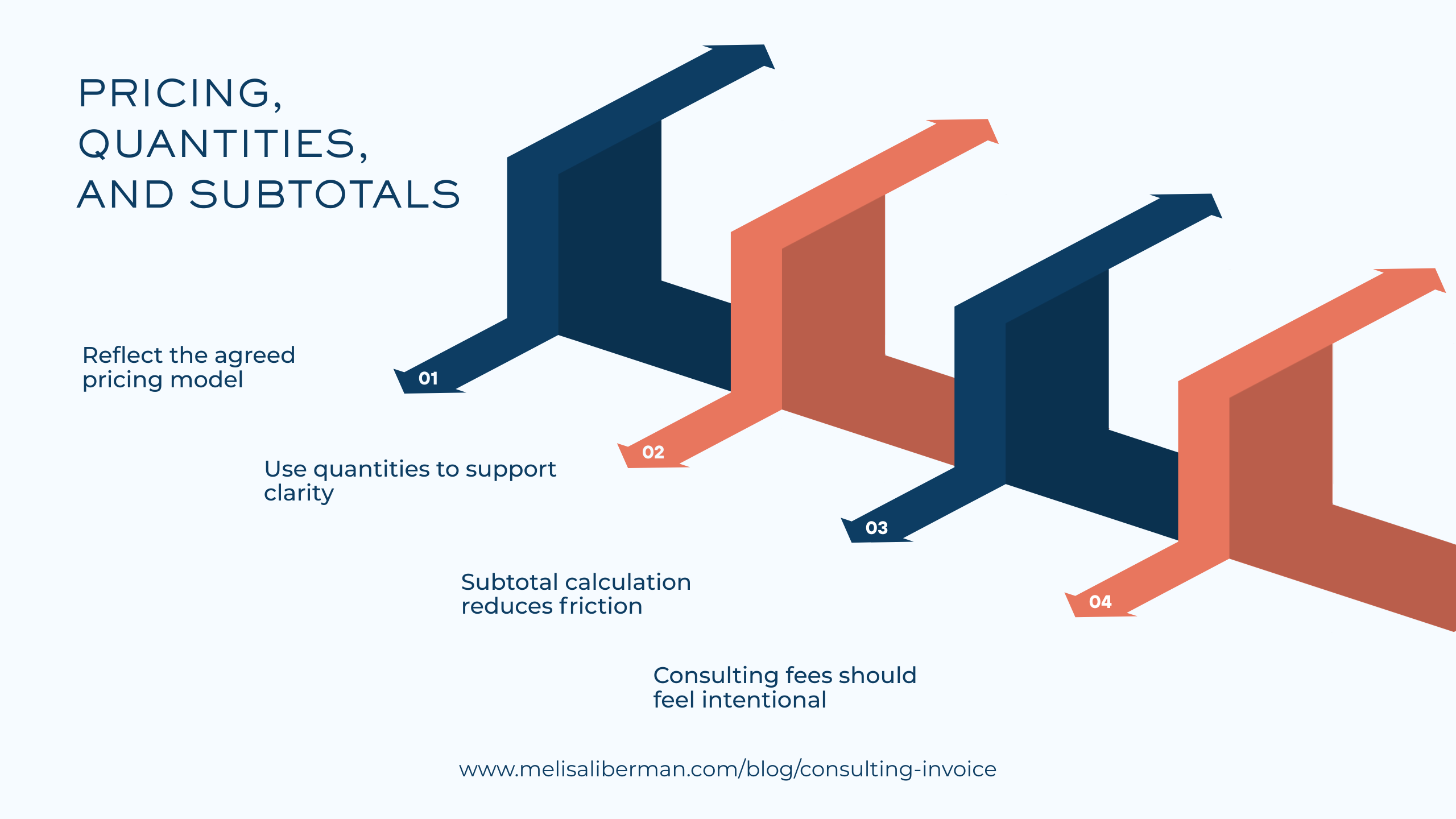

Pricing, quantities, and subtotals

How you present pricing on your consulting invoice directly affects how clients perceive your fees. Clear structure and simple math reduce hesitation and make approvals faster. The goal is transparency without over-justifying your work.

Reflect the agreed pricing model

Your invoice should mirror the pricing model agreed to in your proposal or contract. Whether you charge an hourly rate or a flat fee, consistency reinforces trust and prevents confusion.

For hourly work, clearly state the hourly rate and the number of hours billed for the period. For flat-fee engagements, reference the specific project phase, milestone, or billing period tied to that fee.

Use quantities to support clarity

Quantities help clients understand how fees were calculated. This might include service hours, number of sessions, or defined deliverables.

Used thoughtfully, quantities support clarity without turning your invoice into a defense document. They should explain the cost breakdown at a glance, not invite debate.

Subtotal calculation reduces friction

Each line item should roll up cleanly into a subtotal calculation before taxes or additional charges. Clear subtotals make the total feel logical and predictable.

When clients can follow the math easily, they are less likely to question consulting fees or delay approval. Clean subtotals also support your own internal tracking and reporting.

Consulting fees should feel intentional

An organized pricing section signals that your fees are deliberate and professionally managed. Disorganized pricing or unclear totals can undermine even well-established relationships.

Well-presented pricing, quantities, and subtotals turn your invoice into a confirmation of agreed value, not a point of negotiation.

Taxes and currency notes for U.S. consultants

For U.S. consultants, tax clarity on invoices is essential for compliance and credibility. While taxes can feel outside the core of your consulting work, how you handle them on your invoice directly affects approval, record keeping, and audit readiness.

Sales tax considerations

Not all consulting services are subject to sales tax, and requirements vary by state. Some states tax certain types of services, while others do not. It is your responsibility to understand whether sales tax applies to your work based on state tax regulations.

If sales tax is required, it should be listed as a separate line item rather than bundled into consulting fees. This transparency supports cleaner accounting and aligns with common IRS requirements.

Federal tax compliance basics

Your invoice should include any information needed to support federal tax compliance, such as your business name and tax ID number. This helps clients correctly report payments and issue forms like a 1099 when required.

Clear, consistent invoicing also supports your own records if you are ever asked to substantiate income. Treat invoices as formal financial documents, not casual requests for payment.

Currency notes and international clients

If you work with international clients, specify the currency clearly on every invoice. Even when billing in U.S. dollars, stating the currency avoids confusion and delays.

If currency conversion is involved, include a brief note explaining how totals were calculated or which exchange rate applies. This level of clarity protects both parties and speeds up processing.

Stay aligned with state and federal rules

Tax and currency notes should be consistent across your invoices. This consistency supports compliance, reduces questions from client accounting teams, and helps you maintain accurate records.

When in doubt, consult a qualified tax professional to confirm your obligations. Clear tax handling on invoices is part of running a disciplined consulting business, not an optional detail.

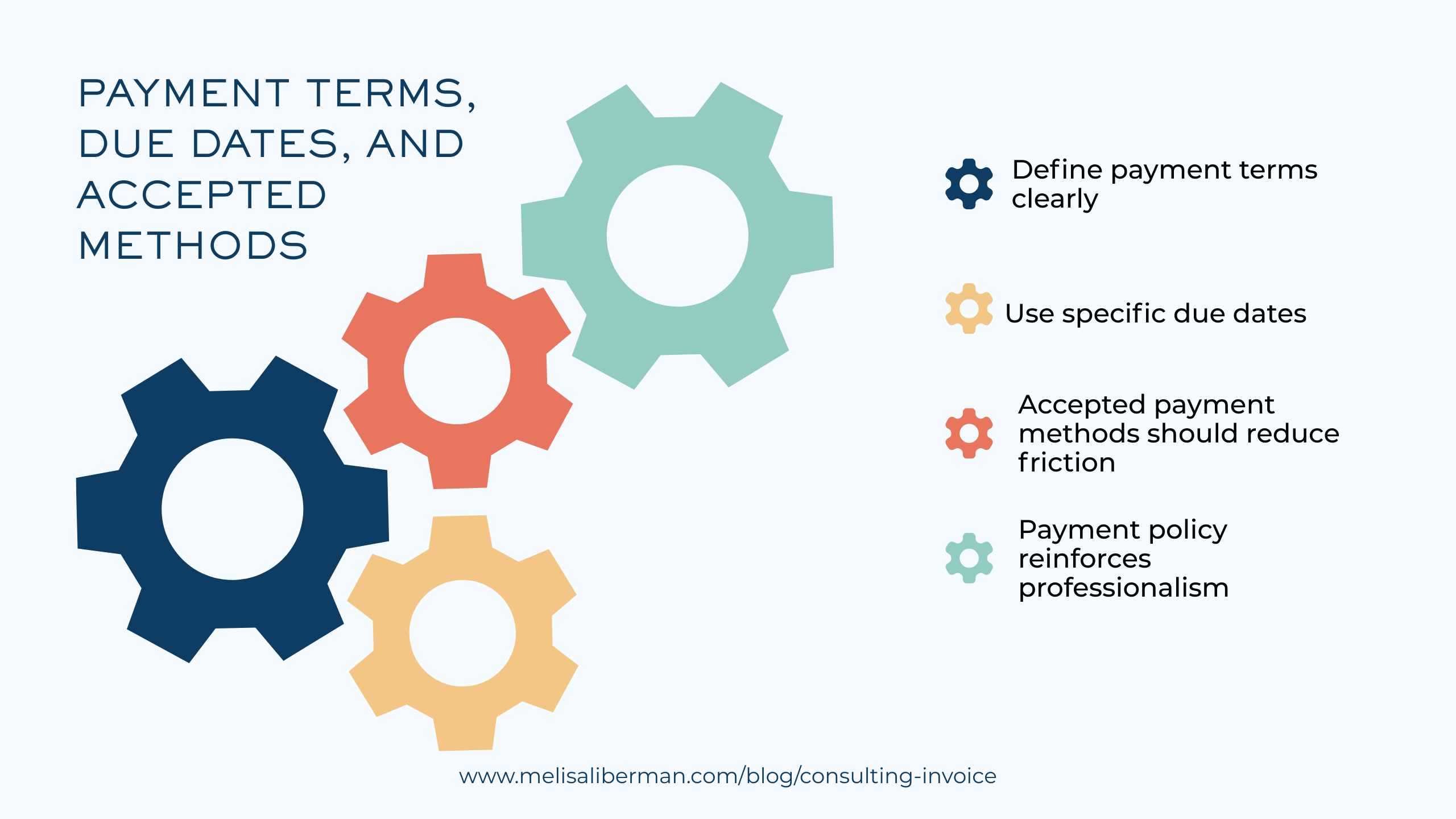

Payment terms, due dates, and accepted methods

Clear payment terms turn invoicing from a request into a policy. When expectations are defined upfront and reinforced consistently, clients know how and when to pay, and you spend less time chasing invoices.

Define payment terms clearly

Payment terms such as net 30, net 15, or due upon receipt should be stated explicitly on every invoice. Avoid assuming clients remember what was discussed earlier. The invoice is the final confirmation of your payment policy.

Shorter terms often support healthier cash flow, especially for solo consultants. Whatever terms you choose, apply them consistently to shape client expectations over time.

Use specific due dates

Pair payment terms with a clear due date. Specific dates reduce ambiguity and make payment deadlines easier to prioritize on the client side.

Clear due dates also support your follow-up process. You know exactly when an invoice becomes overdue and when reminders should be sent.

Accepted payment methods should reduce friction

List accepted payment methods clearly. Common options include ACH transfer, credit card payments, and platforms like PayPal or Stripe.

Offering multiple options can speed up payment, but only include methods you are prepared to manage consistently. Simplicity and reliability matter more than variety.

Payment policy reinforces professionalism

Your invoice should reflect your broader payment policy, including any late fees or escalation steps if payment is delayed. This information does not need to be aggressive, just clear.

When payment terms, due dates, and methods are visible and predictable, clients treat payment as part of the engagement process, not a separate negotiation.

Notes, purchase orders, and special instructions

The notes section of your consulting invoice is where you remove processing friction. For many clients, especially larger organizations, invoices get delayed not because anyone is unhappy, but because your invoice does not match their internal workflow. A few small details here can dramatically speed up approvals.

Include a PO number when required

If a client uses purchase orders, the PO number should be clearly visible on the invoice, typically near the invoice number or in a dedicated field. Accounts payable teams often cannot process invoices without a matching PO, even if the work is already complete.

If you know the client requires a PO, build it into your intake process so you are not asking for it after the fact.

Use custom notes to reinforce context

Custom notes should help the invoice make sense in isolation. Examples include the billing period, project phase, or a short reference to the scope of work.

The goal is not to explain your work in detail, it is to give the approver quick context so they can approve payment without searching through email threads.

Follow client billing instructions exactly

Some clients have specific client billing instructions, such as sending invoices to a particular email address, including internal references, or formatting requirements for vendor portals. These instructions often live in procurement emails or onboarding documents, not in the day-to-day project communication.

Document these requirements early and treat them as part of your invoicing system. When you follow the process precisely, you protect your timeline and reduce the risk of delayed payment.

Add internal references and project codes when relevant

If your client uses internal references or project codes, include them in a consistent place. This helps the invoice get routed correctly and reduces the chance it stalls in accounting.

You can also use this space for your own internal tracking, such as mapping invoices to a specific engagement or retainer period, as long as the note stays client-friendly.

Used well, notes and special instructions keep invoices moving. They make you easier to work with, reduce administrative overhead, and support faster, more predictable payments.

Late fees, interest, and dispute windows

Late fees and dispute windows are not about being punitive. They are about setting clear boundaries so payment stays predictable and professional. When your policies are documented, you reduce ambiguity and protect your cash flow without turning invoicing into a negotiation.

Late payment fees create a clear consequence

Late payment fees signal that paying on time is part of the engagement agreement, not a suggestion. Many consultants avoid adding fees because they worry it will feel harsh, but the opposite is often true. When expectations are clear, clients can plan accordingly, and you avoid awkward follow-ups.

If you use late payment fees, keep the language simple and consistent across your contract and invoices. Make sure the fee structure is easy to understand, and apply it evenly rather than selectively.

Interest rate policy should be specific and compliant

If you charge interest, state the interest rate policy plainly. That includes the rate, how it is calculated, and when it begins. Avoid vague phrasing like “interest may apply” unless you plan to enforce it.

Because rules vary by jurisdiction, align your interest terms with your contract language and applicable laws. The goal is clarity and enforceability, not complexity.

Payment dispute period reduces drawn-out conflicts

A defined payment dispute period helps prevent invoices from being questioned months later when memories are fuzzy and project context has shifted. This window creates a professional expectation: if something is unclear, it should be raised quickly.

A practical approach is to state that invoice disputes must be submitted in writing within a specified number of days from the invoice date. This encourages timely communication and keeps issues contained.

Collection terms protect your time and process

Collection terms outline what happens if payment remains unpaid beyond your deadlines. This can include pausing work, revoking access to deliverables until balances are current, or escalating to formal collections if needed.

You do not need to write this aggressively. Calm, direct language is enough. The presence of clear collection terms often reduces the likelihood you will ever need to use them.

Late fees, interest, and dispute windows work best when they are treated as standard operating procedure. When your boundaries are clear, client payment behavior improves, and you spend less time managing overdue balances.

Scope changes and approvals

Scope issues are one of the fastest ways to turn a smooth engagement into a billing problem. When change requests are handled informally, invoices feel surprising, timelines slip, and you end up negotiating after the work is already done. A clear approval workflow protects the relationship and your revenue.

Treat change requests as part of the process

Change requests are normal, especially in complex work. The problem is not that scope shifts, it is that scope shifts without structure.

Set the expectation early that any work outside the original scope of work requires a written request and a decision. This creates a clean line between what is included and what is additional, which makes invoicing straightforward.

Prevent scope creep with documented decisions

Scope creep often happens through small favors: “Can you just add this?” or “It will only take a minute.” Over time, those extras pile up and the invoice becomes hard to defend because the agreement was never updated.

A simple discipline helps: if it is outside scope, it gets documented. That could be an email confirmation, a formal change order, or a short contract amendment. The format matters less than the habit of making it explicit.

Build an approval workflow you can actually follow

An approval workflow should be lightweight enough to use consistently. Aim for a repeatable sequence:

- Client submits the request in writing.

- You respond with impact on timeline, deliverables, and fees.

- Client approves in writing before you begin.

- You reflect the change through invoice adjustments tied to a milestone or the next billing cycle.

This approach reduces disputes because the client has agreed to the cost before it appears on the invoice.

Use contract amendments to keep billing defensible

For larger changes, contract amendments are worth the extra step. They formalize expectations, reduce ambiguity, and make future invoices easier to approve. They also protect you if internal stakeholders change on the client side.

When your agreements and invoices stay aligned, billing feels fair and predictable. Scope changes become a managed decision, not a hidden cost, which is better for both cash flow and trust.

Consulting invoice templates and real examples

A well-designed consulting invoice template saves time, reduces errors, and creates a consistent experience for clients. While the exact format may vary based on your services and clients, the underlying structure should always support clarity, professionalism, and easy approval.

What a strong consulting invoice template includes

An effective template design balances completeness with simplicity. It includes all required invoice fields without overwhelming the reader. A professional invoice layout makes it easy for clients to quickly find key information like totals, due dates, and payment instructions.

Look for or create an editable invoice that allows you to reuse the same structure while updating details for each engagement. Consistency matters more than visual flair.

Reviewing a consulting invoice sample

A solid consulting invoice sample typically includes:

- Clear consultant and client contact details at the top

- A unique invoice number, issue date, and due date

- Concise service descriptions tied to deliverables or billing periods

- Transparent pricing, quantities, and subtotals

- Payment terms, accepted methods, and any required tax notes

- Space for PO numbers, internal references, or special instructions

When these elements are present and easy to scan, invoices move through approval faster.

Templates should support your pricing and delivery model

Not all invoice examples are interchangeable. A template that works for hourly advisory work may not fit project-based or retainer engagements. Your consulting invoice template should reflect how you sell and deliver your services.

If you regularly work in phases or milestones, your template should accommodate that structure. If you bill monthly, it should clearly indicate billing periods and recurring fees.

Use real examples to pressure-test your process

Before finalizing a template, run a few real scenarios through it. Test different client types, pricing models, and payment terms. This helps you spot gaps before they create problems.

A thoughtful template is a system, not a document. When your invoice examples hold up across situations, you spend less time fixing issues and more time focusing on client work.

Sample consulting invoice

Seeing a sample consulting invoice makes the structure and intent much clearer than a checklist alone. Like a strong consulting one-pager, a good invoice is designed to communicate quickly, feel intentional, and reinforce your positioning.

A clean invoice format example typically fits on one page, whether delivered as a PDF consulting invoice or through an invoicing platform. The layout should guide the reader’s eye from top to bottom without friction.

What this visual example demonstrates

A strong sample invoice usually includes:

- A branded header with your logo, business name, and contact details, aligned with your overall professional branding

- Clearly separated sections for client details, invoice number, issue date, and due date

- A structured services table that highlights consulting deliverables, billing periods, or milestones

- Clear subtotals, taxes if applicable, and a prominent total due

- Payment terms and accepted methods placed where they are easy to find

- A small notes section for PO numbers or client-specific instructions

This mirrors the role of a consulting one-pager. Both documents summarize value, reduce questions, and support confident decision-making.

Why branded invoice templates matter

A branded invoice template signals consistency. It shows clients that your invoicing is part of a system, not an afterthought. Fonts, spacing, and layout should match the level of professionalism found in your proposals and client-facing materials.

This does not require complex design. Simple alignment, white space, and clear hierarchy are enough to create a professional invoice layout that feels credible and easy to approve.

How to use a sample invoice effectively

Treat this visual example as a reference point, not a rigid rule. Your final template should reflect how you price, scope, and deliver your services.

Test your branded invoice template with real scenarios before locking it in. If it works cleanly for different clients, pricing models, and billing cycles, it will support faster payments and fewer follow-ups over time.

A strong sample consulting invoice reinforces that payment is a natural extension of your consulting process, not a separate or uncomfortable step.

Line-by-line breakdown of the sample consulting invoice

A line-by-line walkthrough helps you understand not just what appears on a consulting invoice, but why each element exists. This template walkthrough shows how each section works together to support clarity, approval, and timely payment.

Header and branding

The top of the invoice establishes credibility. This section typically includes your business name, logo, and contact information. Its role is simple: make it immediately clear who the invoice is from and reinforce professional branding.

In a sample invoice, this mirrors the role of a consulting one-pager. It sets context before details appear.

Client information and references

Next comes the client’s legal business name, address, and any internal reference such as a contact person, project code, or PO number. These invoice fields are explained here because they are critical for routing the invoice correctly, especially in larger organizations.

Accuracy in this section directly affects processing speed.

Invoice number, issue date, and due date

This block anchors the invoice in time. The invoice number enables tracking, the issue date establishes when billing occurred, and the due date sets a clear payment deadline.

Together, these fields support invoice management and make follow-ups straightforward and factual.

Service description and line item details

This is the core of the invoice. Each line item details the consulting service provided, tied to a billing period, milestone, or deliverable.

In the sample consulting invoice, descriptions are concise but specific. They align with the original scope of work so the client immediately recognizes what they are paying for. This alignment reduces disputes and reinforces value.

Pricing breakdown and quantities

Each line item includes a price, quantity if applicable, and a calculated total. This pricing breakdown should match the agreed pricing model, whether that is a flat fee, retainer, or hourly structure.

Clear math builds confidence. Clients should be able to scan this section and understand the total without questioning how it was calculated.

Subtotals, taxes, and total due

Below the line items, the invoice rolls up into subtotals, any applicable taxes, and the final amount due. This section confirms the numbers and makes the payment decision easy.

Visibility matters here. The total due should stand out so there is no ambiguity about what needs to be paid.

Payment terms and methods

This section explains how and when to pay. It includes payment terms, due dates, and accepted payment methods. In an example invoice, this information is easy to find and written in plain language.

Clear payment instructions reduce delays and unnecessary follow-up.

Notes and special instructions

Finally, the notes section captures anything specific to the client or engagement, such as billing periods, reminders about contract terms, or required references.

Used well, this section removes friction without adding clutter.

A line-by-line breakdown reveals that a strong consulting invoice is not about design flair. It is about intentional structure. When each section has a purpose, the invoice supports faster approvals, fewer questions, and more predictable cash flow.

Download this consulting invoice template to get started

If you want to stop overthinking invoicing and start using a structure that works, a solid template makes the difference. A free consulting invoice template gives you a starting point that covers the essentials without forcing you to design a system from scratch.

This editable invoice download is built specifically for consultants. It prioritizes clarity, professional presentation, and easy approval, so you can focus on client work instead of fixing billing issues.

What you get with this template

The template is designed to be flexible and practical. You can use it as a:

- Google Docs invoice for easy sharing and version control

- Excel invoice template if you prefer formulas and automated totals

- Word invoice format for offline editing or PDF export

Each version includes the core fields consultants need, including service descriptions, pricing breakdowns, payment terms, and space for client-specific notes.

How to use it effectively

Before sending your first invoice, customize the template with your branding, default payment terms, and preferred payment methods. Then test it with a real engagement to make sure it supports your pricing model and delivery style.

Treat this as a foundation, not a final destination. As your consulting business evolves, your invoice should evolve with it.

A clear, professional invoice template removes friction from the payment process. Download it, tailor it to your business, and use it as part of a repeatable system that supports predictable cash flow and confident client relationships.

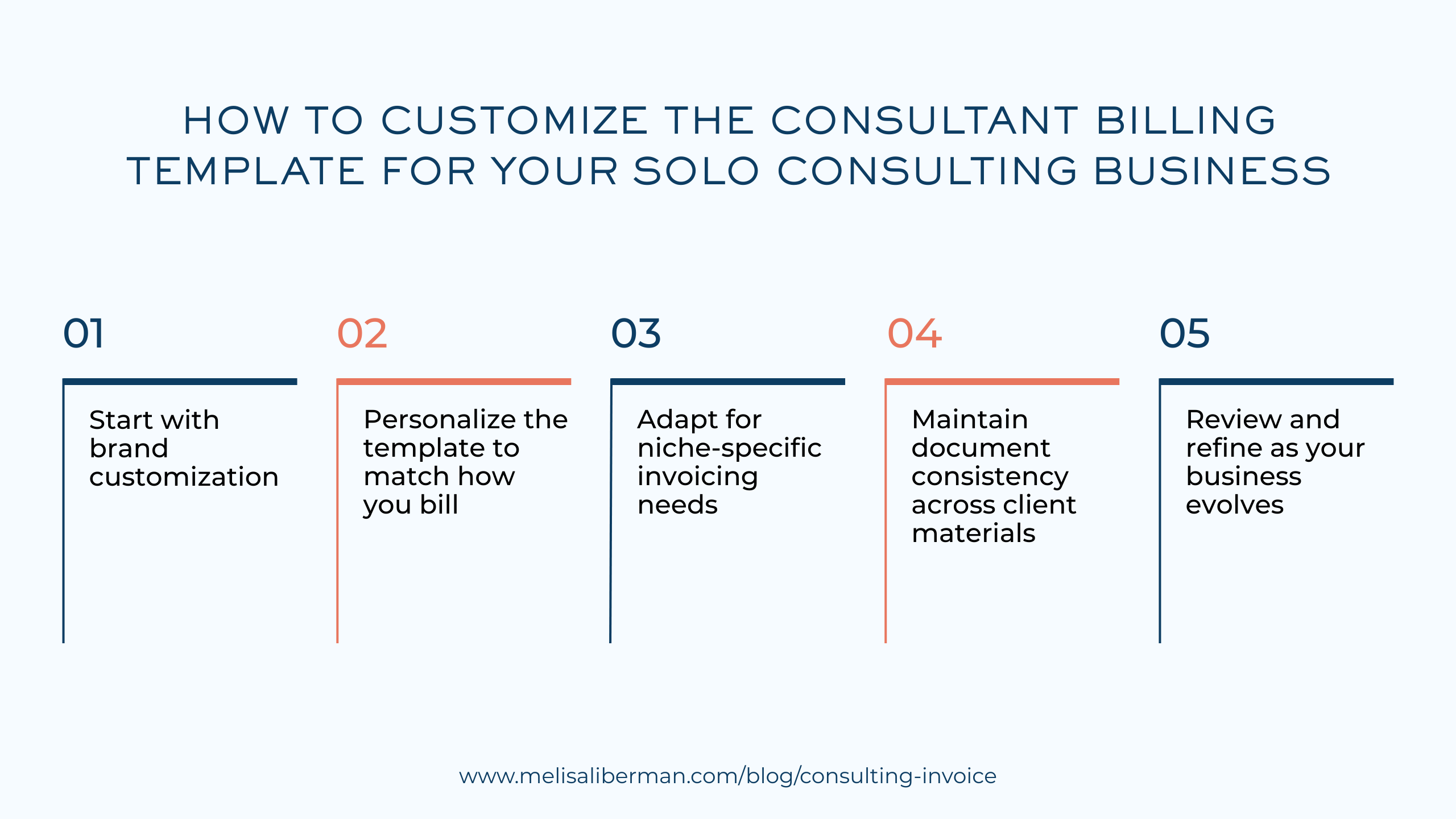

How to customize the consultant billing template for your solo consulting business

A consultant billing template should feel like it belongs to your business, not like a generic form you downloaded and filled in. Customization is not about design flair. It is about alignment, clarity, and consistency across your client experience.

Start with brand customization

At a minimum, add your logo and business name to the template. Use a simple logo placement and a restrained color scheme that matches your website and proposals.

This level of brand customization reinforces professionalism without distracting from the invoice content. Consistent fonts, spacing, and colors help clients recognize your documents instantly.

Personalize the template to match how you bill

Template personalization should reflect your actual billing model. If you bill by project milestones, structure the services section around phases rather than hours. If you work on retainers, include a clear billing period and recurring fee line.

Avoid leaving unused fields in place. Removing irrelevant sections reduces confusion and keeps the invoice focused on what matters.

Adapt for niche-specific invoicing needs

Different niches have different invoicing expectations. Some clients require detailed line items, while others prefer high-level summaries. Some need PO numbers and internal references, while others do not.

Use your experience with clients to adjust the template. Niche-specific invoicing helps your invoice move through approval faster because it fits the client’s workflow.

Maintain document consistency across client materials

Your invoice should align with your proposals, contracts, and onboarding documents. Use the same service names, terminology, and structure wherever possible.

Document consistency builds trust and reduces friction. When everything matches, clients spend less time questioning details and more time approving payment.

Review and refine as your business evolves

Revisit your template periodically. As your services, pricing, or client mix changes, small adjustments keep your invoicing system relevant.

A well-customized consultant billing template supports your positioning and protects your time. It turns invoicing into a reliable system rather than a recurring administrative headache.

Best format, tools, and invoicing software for your consulting invoices

The best invoicing setup is the one you will actually use consistently. For solo consultants, the goal is reliability, clarity, and minimal overhead. Choosing the right format and tools supports faster payments and reduces administrative drag.

Choosing the right invoice format

Most consultants default to sending invoices as PDFs, and for good reason. A PDF preserves formatting, prevents accidental edits, and feels final. This makes it the preferred option for client-facing delivery.

Word invoices can work internally or during setup, but they introduce risk once sent. Formatting can shift, fields can be edited, and version control becomes harder. For most consultants, a Word invoice is best used to build the template, not to send the final invoice.

A clean PDF vs Word invoice decision usually comes down to professionalism and control. PDFs win in most client scenarios.

When cloud-based invoicing makes sense

Cloud-based invoicing tools reduce manual work by automating invoice creation, numbering, reminders, and tracking. If you invoice regularly or manage multiple clients, this can significantly improve consistency.

These tools also centralize invoice management. You can see what has been sent, what is overdue, and what has been paid without digging through folders or email threads.

Popular invoice software options for consultants

Invoice software like QuickBooks and FreshBooks are commonly used by consultants because they balance functionality with usability.

QuickBooks is often chosen by consultants who want invoicing tightly integrated with accounting and reporting. FreshBooks tends to appeal to service-based businesses that want simpler invoicing, time tracking, and client-facing portals.

The right choice depends on how complex your finances are and how much automation you want. The software should support your workflow, not dictate it.

Match tools to your stage of business

Early-stage consultants may be well served by a simple template and PDF delivery. As volume increases, software becomes more valuable.

Avoid over-engineering your setup too early. Start with what keeps invoices accurate and on time, then upgrade tools when manual processes start to slow you down.

The best invoicing system is one that fades into the background. When your format and tools are aligned with how you work, invoicing becomes routine, predictable, and easy to manage.

Automating your consulting invoices and reminders

Automation is not about removing judgment from your business. It is about removing friction. For solo consultants, invoice automation protects your time and ensures billing happens consistently, even when client work gets busy.

Where automation adds the most value

Automation works best for repeatable actions. Creating invoices, sending them on a schedule, and following up on unpaid balances are all prime candidates.

Auto-billing reduces the risk of forgetting to send an invoice or sending it late. Consistent timing improves client payment behavior and supports better cash flow management.

Recurring invoices for ongoing work

If you offer retainers or monthly advisory support, recurring invoices are one of the simplest ways to improve workflow efficiency. Once set up, the system generates and sends invoices automatically based on your billing cycle.

This removes decision fatigue and keeps your focus on delivery. Clients also benefit from predictability, which reduces questions and delays.

Payment reminders that feel professional

Automated payment reminders remove the emotional weight from follow-up. Instead of deciding when and how to nudge a client, the system handles it based on predefined rules.

Well-timed reminders are factual and neutral. They reinforce your payment terms without damaging the relationship. Over time, this consistency trains clients to pay on time.

Balance automation with oversight

Automation should not mean set-and-forget. Review invoices periodically to ensure accuracy, especially when scopes change or new clients are added.

Use automation to support your workflow, not replace attention to detail. The goal is fewer manual tasks and fewer errors, not less control.

When implemented thoughtfully, automating your consulting invoices and reminders creates a quieter, more predictable billing system. It frees up mental space so you can focus on work that actually drives your business forward.

Best practices to get paid on time for your consulting invoices

Getting paid on time is rarely about chasing harder. It is about designing a system that makes timely payment the default outcome. For solo consultants, a few consistent practices can significantly improve on-time payments without straining client relationships.

Set payment policies before work begins

Payment policies should be discussed and documented before an engagement starts. This includes payment terms, billing frequency, and consequences for late payment.

When expectations are set early, invoices feel routine rather than surprising. Clients are far more likely to respect terms they agreed to upfront.

Maintain billing consistency

Consistency builds trust and predictability. Send invoices on the same schedule, use the same format, and apply the same terms across clients whenever possible.

Inconsistent billing trains clients to deprioritize payment. Billing consistency reinforces that invoicing is part of your operating rhythm, not an ad hoc task.

Use invoice scheduling strategically

Invoice scheduling supports both cash flow and client behavior. For project work, tie invoices to milestones rather than the end of the engagement. For ongoing work, invoice at the same point each month.

This approach reduces large outstanding balances and keeps payments aligned with delivery.

Protect client relationships through clarity

Clear invoices protect relationships. When service descriptions, totals, and due dates are obvious, clients are less likely to push back or delay.

If a payment is late, address it promptly and professionally. Neutral follow-up preserves goodwill while reinforcing boundaries.

Treat payment as part of delivery

The most effective consultants treat billing as part of the service experience. Invoices are timely, accurate, and easy to approve.

When your payment process is predictable and well-managed, clients mirror that professionalism. On-time payments become the norm, not the exception.

Set payment expectations in your proposal and SOW

If you want invoices to be paid on time, the work starts long before the invoice is sent. Your proposal and statement of work should establish payment expectations clearly so billing never feels negotiable later.

Use clear payment clauses in your proposal

Your proposal terms should outline how and when you will be paid. This includes pricing, billing frequency, payment terms, and accepted payment methods.

Avoid vague language. Clear payment clauses set the tone and signal that payment is part of the engagement structure, not an administrative afterthought.

Reinforce expectations in the statement of work

The statement of work should mirror the proposal and add operational detail. This is where you confirm invoicing timing, milestone payments, retainers, and any deposits required.

Consistency between documents matters. When proposal terms and the SOW align, there is no room for interpretation once work begins.

Align contracts and invoices

Contract alignment reduces disputes. Use the same terminology, service descriptions, and payment language across your proposal, SOW, contract, and invoices.

This alignment makes invoices easier to approve because they feel like a continuation of agreed terms, not a new request.

Document a clear payment policy

A clear payment policy protects both parties. It outlines due dates, late fees if applicable, and what happens if payment is delayed.

When clients understand the process upfront, payment becomes predictable. Strong payment expectations in your proposal and SOW make timely invoicing feel inevitable rather than awkward.

Invoice timing and frequency that improve cash flow

Most cash flow problems in solo consulting are timing problems. You can be profitable and still feel stressed if your invoicing cadence does not match your delivery cadence. A strong invoice timing strategy makes revenue more predictable and reduces the gap between work completed and money received.

Monthly billing for ongoing engagements

Monthly billing is often the simplest way to stabilize cash flow. If you provide ongoing advisory support, a retainer, or recurring delivery, monthly invoices create a consistent rhythm for both you and the client.

The key is consistency. Invoice on the same date each month, tie the invoice to a clear billing period, and keep terms consistent. This supports cash flow forecasting because you know what revenue should arrive and when.

Project milestones for project-based work

For project-based work, invoicing at the end is a common mistake. It increases accounts receivable risk and forces you to carry the project financially.

Instead, use project milestones. Milestone invoicing aligns payments with progress, reduces unpaid balances, and keeps the client engaged in the payment process throughout delivery. Common milestones include:

- Deposit to start work

- Payment at completion of discovery

- Payment at delivery of recommendations or key deliverables

- Final payment at handoff or project close

This approach also makes invoice approvals easier because each invoice corresponds to a clear stage of work.

Retainer invoices that protect capacity

Retainer invoices are most effective when billed in advance. Billing at the start of the month or period reinforces that the client is reserving your capacity, not paying after the fact for time already spent.

This structure also improves forecasting. Predictable retainer payments allow you to plan workload, staffing, and expenses with more confidence.

Choosing a frequency you can sustain

The best timing and frequency are the ones you will execute consistently. Do not choose an invoicing schedule that requires constant manual effort or decision-making.

A repeatable cadence improves client payment behavior, supports forecasting, and reduces stress. When invoice timing matches the reality of how you deliver services, cash flow becomes a managed system instead of a recurring surprise.

Managing reimbursable expenses the right way

Reimbursable expenses can quietly erode profitability and create friction if you do not manage them with the same discipline as your fees. The goal is simple: clients should understand what is billable, approve it when required, and reimburse it quickly, without you floating costs or debating line items later.

Set an expense reimbursement policy upfront

The right time to define expenses is in your proposal, SOW, or contract, not after you have already spent money. Your expense reimbursement policy should clarify:

- What qualifies as billable expenses

- Whether expenses are billed at cost or with an admin markup

- When expenses will be invoiced (monthly, alongside milestones, or as incurred)

- Any limits or caps that require written approval

This makes expense reporting feel like part of the engagement structure, not a surprise add-on.

Require client expense approval when needed

Many disputes happen because consultants assume something is “obviously reimbursable” and clients assume the opposite. If an expense is material or non-routine, get client expense approval in writing before incurring it.

A simple rule: if you would be annoyed paying it yourself without warning, treat it as an approval-first item. This protects the relationship and makes reimbursement automatic.

Keep receipts and documentation clean

Receipts and documentation are not optional if you want fast reimbursement. Keep records organized and easy to match to each expense line item.

When you submit expenses, include enough detail to make approval effortless: date, vendor, purpose, and how it ties to the engagement. This level of clarity reduces questions and speeds up processing.

Make expense reporting easy to review

Expense reporting should be scannable. Itemize each expense with a short description, and group related items when helpful (travel, software, workshop materials).

If you have multiple expenses, attach a PDF receipt bundle or provide a clear file naming system so the client’s accounting team can reconcile quickly.

Invoice expenses in a way that protects cash flow

Avoid carrying reimbursable costs for long periods. For larger expenses, bill as incurred or include them in the next scheduled invoice rather than waiting until project close.

This reduces the chance of delays and keeps your cash flow stable, especially if travel or software purchases are involved.

Managed well, reimbursable expenses feel routine. They sup

Late payment follow-ups and reminder cadence

A late payment follow-up process works best when it is boring, consistent, and written down. You are not trying to “win” a conversation, you are reinforcing a standard. The right reminder cadence removes emotion, protects client relationships, and increases the likelihood you get paid without escalating to collections.

Build a simple reminder cadence you can stick to

A practical cadence for most solo consultants looks like this:

- 3 days before the due date: friendly heads-up reminder

- On the due date: short note confirming the invoice is due today

- 3 to 5 days after due: first overdue reminder, assume good intent

- 10 to 14 days after due: firmer reminder, ask for a payment date

- 21 to 30 days after due: escalation step, reference collection terms and pause work if applicable

The exact timing matters less than consistency. A predictable cadence trains client payment behavior and keeps accounts receivable from drifting.

Keep invoice reminders short and factual

The best invoice reminders are simple. Include the invoice number, amount, due date, and payment link or instructions. Avoid long explanations or apologies.

Friendly reminders should sound like an operations team, even if it is just you. You can be warm without being vague.

Use a payment follow-up email that asks for action

When an invoice is overdue, your payment follow-up email should request one of two things:

- Confirmation that payment has been submitted, or

- The exact date payment will be made

This shifts the conversation from “Did you see this?” to “What is the plan?” It is a subtle but powerful collections strategy that keeps things professional.

Escalate without damaging the relationship

If reminders are ignored, escalation is not rude. It is responsible. Your next steps might include pausing work, withholding deliverables until the balance is current, or moving to formal collections based on your contract.

State the next step clearly and calmly, then follow through. Inconsistent enforcement creates more late payments over time than any “difficult client” ever will.

Create client communication templates to reduce mental load

Templates make this process easier. Write 3 to 5 versions once, then reuse them. This improves workflow efficiency and prevents you from rewriting emails while frustrated.

When your reminder cadence is consistent and your language is neutral, late payments become an operational issue you handle, not a personal stressor you absorb.

Offer early-pay incentives (and when not to)

Early-pay incentives can improve cash flow, but they are not always the right lever for a solo consultant. The decision is less about generosity and more about economics and positioning. If you offer an early payment discount, it should be intentional, bounded, and aligned with how you want clients to value your work.

When early payment discounts make sense

An early payment discount can be effective when faster cash materially reduces stress or risk in your business. For example:

- You are funding subcontractors or project costs upfront and want to reduce cash flow gaps.

- You are moving from irregular project billing to a more predictable system and want to shape client behavior quickly.

- You have a client base that responds well to simple financial incentives and pays through accounts payable workflows.

In these scenarios, invoice incentives can be a practical tool for client motivation. The key is to treat them as a strategic cash flow tradeoff, not a default discount.

Understand the cash flow tradeoffs

Discounting is never free. You are trading margin for speed. Before offering an early payment discount, ask:

- What is the actual cost of delayed payment to me?

- Does faster payment change my ability to deliver, invest, or take on new work?

- Am I training clients to expect discounts as part of my pricing?

If the discount is larger than the value of faster cash, it is not a smart trade.

Set a clear discount policy

If you decide to offer incentives, document a discount policy that is simple and consistent. Define:

- The discount amount or percentage

- The payment window (for example, paid within 5 or 7 days of invoice date)

- Whether it applies to all invoices or only specific engagements

- How it will be reflected on the invoice (line item discount or adjusted total)

This keeps incentives professional and prevents clients from negotiating ad hoc discounts later.

When not to offer early-pay incentives

Early-pay incentives are a poor fit when they undermine your positioning or create unnecessary complexity. Avoid them when:

- You already have strong on-time payment behavior and predictable cash flow.

- Your clients pay through rigid procurement systems where discounts do not change timing.

- Discounts create a perception that your fees are negotiable.

- You would rather enforce payment terms consistently than incentivize compliance.

In many cases, consistent invoicing, firm terms, and automated reminders produce better long-term results than discounts.

Early-pay incentives can work, but only when they solve a real cash flow problem and support the standards you want in your business.

Frequently asked questions about consulting invoices

What should a consulting invoice include?

At a minimum: your business and client contact details, a unique invoice number, issue date and due date, clear service descriptions tied to the scope of work, pricing and subtotals, taxes if applicable, and payment terms with accepted methods. Add PO numbers, project codes, or internal references when a client requires them.

Should I bill hourly or use a flat fee?

Use the model that matches how you sell and deliver value. Hourly billing can work for open-ended support or defined time blocks, but flat fees and milestone billing often make value clearer and reduce time-based scrutiny. The most important thing is consistency between your proposal, SOW, and invoice.

What payment terms are standard for consulting invoices?

Net 30 is common, but “standard” depends on your client type and leverage. Many solo consultants use net 14 or due upon receipt for smaller clients, and net 30 for larger organizations with longer approval cycles. Choose terms you can enforce calmly and consistently.

When should I send my invoice?

Send invoices as close to delivery as possible, based on your structure. For retainers, bill in advance at the start of the billing period. For projects, invoice on milestones instead of waiting until the end. This keeps accounts receivable smaller and improves cash flow.

How do I handle late payments without damaging the relationship?

Use a consistent reminder cadence, keep messages short and factual, and ask for a specific payment date once the invoice is overdue. Friendly tone, firm process. If payment continues to slip, follow your stated policies, including pausing work if needed.

Should I charge late fees or interest?

Only if you are willing to enforce it. Late fees and interest are most useful as boundary-setting tools, not revenue tools. Keep the policy simple, include it in your contract and invoices, and ensure it is compliant with applicable rules in your jurisdiction.

What if a client disputes an invoice?

First, check whether the dispute is about scope, expectations, or billing clarity. Refer back to the proposal and SOW language, and keep communication in writing. This is also why a defined dispute window is helpful, it keeps disagreements timely and contained.

How do I prevent nonpayment?

Start before the work begins: deposits, milestone payments, clear payment terms, and a client onboarding process that confirms billing contacts and requirements. Nonpayment prevention is mostly about structure and client selection, not collections tactics.

Can I use a template, or do I need invoicing software?

A template is fine if your volume is low and your process is consistent. Invoicing software becomes valuable when you want automated numbering, recurring invoices, reminders, and tracking. Many consultants start with a template and move to tools like QuickBooks or FreshBooks when complexity increases.

Should I send invoices as PDF, Word, or something else?

Send invoices as PDF whenever possible. PDFs preserve formatting, reduce accidental edits, and feel final. Use Word or Google Docs to build the template, then export to PDF for delivery unless your invoicing software generates the invoice directly.

Do I need a contract or SOW before invoicing?

Yes. If you want invoices to be paid smoothly and defended easily, you need a consulting contract or a statement of work (SOW) in place before you invoice. Invoicing without legal documentation leaves too much open to interpretation and weakens your payment protection.

A client agreement establishes what work is included, how it will be delivered, and how and when you will be paid. When an invoice references an agreed scope and fee structure, it feels like a confirmation of terms, not a new request.

For many consultants, the SOW does the heavy lifting. It outlines services, timelines, deliverables, pricing, and payment terms in operational detail. The consulting contract provides the legal framework, while the SOW handles execution. Together, they create clarity and reduce disputes.

If a client pushes to start work without documentation, that is a signal to slow down, not speed up. A signed agreement protects your time, your cash flow, and the relationship. It gives you something concrete to point to if questions arise and makes invoicing a routine step rather than a negotiation.

What if a client requests net-60 terms?

Net-60 is not automatically a dealbreaker, but it is an extended payment term, and you should treat it like a business decision, not a courtesy. The question is: can your solo consulting business absorb the cash flow impact without creating stress or forcing you to self-finance the engagement?

Start by translating “net-60” into reality. If you invoice at the end of a month and they pay 60 days later, you could be waiting 75 to 90 days for cash. That timeline changes how you staff, schedule, and price.

Here are practical ways to handle it while maintaining client relationship management and invoice flexibility:

- Negotiate the timeline, not just accept it. Offer net-30 as your standard, or propose net-45 as a compromise. Many clients ask for net-60 because it is their default, not because it is required.

- Use a deposit or upfront retainer. A common structure is 30% to 50% upfront, then net-60 for remaining milestone invoices. This reduces the cash flow impact while respecting their internal process.

- Shift to milestone billing with smaller balances. If they must have net-60, do not carry the full project cost until the end. Break the work into project milestones and invoice as each phase is approved.

- Price for the financing cost. Extended payment terms are effectively you providing credit. If you accept net-60, consider adjusting consulting fees to reflect the risk and delayed cash.

- Confirm the approval workflow in writing. Ask who approves invoices, whether a PO is required, and how long processing typically takes. This is part of negotiating payment timelines. It reduces surprises and improves on-time payment behavior even under longer terms.

If the client is a strong fit and the engagement is strategically valuable, net-60 can be workable with the right structure. If accepting it forces you into cash flow anxiety or inconsistent enforcement, it is better to negotiate or walk away than to start resentful and under-protected.

How detailed should service descriptions be on the invoice?

Detailed enough that the client immediately recognizes what they are paying for, but not so detailed that your invoice turns into a timesheet or a justification document.

A good rule: your service descriptions should map cleanly to the scope of services in your proposal and SOW. That alignment creates invoice transparency and reduces disputes because the invoice reads like a continuation of what was agreed.

Itemization best practices for consultants:

-

Name the service or deliverable, not the internal tasks. “Stakeholder interview synthesis and findings memo” is better than “Notes, research, and analysis.”

-

Anchor it to a time period or milestone. “Monthly advisory support (Dec 1 to Dec 31, 2025)” or “Phase 2: Implementation plan delivered.”

-

Include deliverable details only when it improves clarity. For example, “Facilitated 1x 90-minute workshop + summary deck” is often enough.

-

Avoid excessive granularity unless required. If the client contract requires line-by-line hours, provide them. Otherwise, do not create a minute-by-minute breakdown that invites scrutiny.

How this changes by billing model:

-

Flat fee / project-based: Use milestone-based descriptions tied to outputs and approvals.

-

Retainers: Use the billing period and what the retainer covers at a high level.

-

Hourly: Group hours by category or outcome (strategy, calls, review, implementation) instead of listing every micro-task.

If you are unsure, ask yourself: “Could someone in accounts payable approve this without calling the project team?” If the answer is yes, you have the right level of clarity in billing.

What counts as “receipt” for payment timelines?

“Receipt” is one of the most misunderstood words in invoicing, and relying on it without definition can create avoidable delays. For payment timelines, receipt should be clearly defined as a specific, trackable event, not an assumption.

In practice, receipt usually means the invoice delivery date, not the moment a client opens or acknowledges it.

Common definitions of receipt

Receipt is typically triggered by one of the following, depending on how you send invoices:

- Email delivery: The date and time the invoice is sent to the agreed billing email address.

- Invoicing software delivery: The system timestamp showing the invoice was issued and delivered.

- Client portal upload: The date the invoice is uploaded to the required platform, as shown in system logs.

Waiting for an email acknowledgment is risky. Many clients never confirm receipt, even when the invoice is in their system.

Why “due upon receipt” causes problems

Phrases like “due upon receipt” sound firm but are operationally vague. They leave room for disagreement about when the payment timeline starts.

Instead, define the payment timeline start explicitly. For example:

“Payment is due within 14 days of the invoice issue date.”

This removes ambiguity and supports invoice tracking and follow-up.

Proof of delivery protects you

Sending invoices through a system that provides proof of delivery makes follow-ups easier. Email timestamps, read receipts from invoicing software, or portal upload confirmations all help establish when the clock started.

If a client disputes timing, you can point to objective records rather than opinion.

Best practice for consultants

- Define receipt in your contract or payment policy.

- Use issue date–based terms instead of “receipt” language.

- Send invoices to a single, agreed billing contact.

- Track delivery consistently.

Clear definitions turn payment timelines into facts, not arguments. When receipt is unambiguous, late payments are easier to address calmly and professionally.

Get the help you need to grow your independent consulting business the right way

This article walked through what professional consulting invoicing actually requires, from clear service descriptions and payment terms to reminder cadences, scope controls, and cash flow–friendly billing practices. The throughline is simple: getting paid on time is not about chasing clients, it is about building systems that support clarity, consistency, and confidence.

When invoicing, contracts, and payment policies are designed intentionally, they reinforce your positioning instead of undermining it. They also free up mental space so you can focus on higher-value work rather than administrative cleanup.

Why IC-Grow supports sustainable consulting growth

The Scale-IC Program is designed for independent consultants who want to grow without creating chaos. That includes tightening how you scope work, price services, invoice clients, and manage cash flow as your business matures.

Inside the program, consultants work on:

- Designing services that are easier to scope, sell, and bill

- Aligning proposals, SOWs, contracts, and invoices so nothing feels improvised

- Building operational systems that support growth without burnout

- Making strategic decisions from a position of control, not urgency

This is not about templates alone. It is about ownership, leverage, and building a consulting business that works for you long term.

Click here for details.

Take the next step

If you want support building a consulting business with stronger systems, clearer boundaries, and more predictable revenue, the next step is a conversation.